Table of Contents

In September 2020, Google Ads announced that only search terms that “a significant number of users searched for” would be included in the search terms report. Following this change, some advertisers estimate that upwards of 50% or more of search terms are no longer being reported on, which many in the PPC community view as a major impediment to proper account optimization.

Related Content:

Search terms are defined as “the exact word or set of words a customer enters when searching” on Google. From a PPC perspective, search terms are a window into the actual intent of the searcher and how a campaign’s keywords are triggering ads based on that intent. Historically, advertisers have relied heavily on search term reports to better understand keyword performance and ensure that their ads are not showing for irrelevant searches (and wasting ad spend in the process).

This change to search term reporting does create significant limitations in account optimization. However, for most accounts, we know that in the long term it’s not efficient to use the search term report to play whack-a-mole with negative keywords. Rather, broad keywords and search term reports are an excellent way to gather the data necessary to eventually transition to a tighter audience and set of keywords for terms that have significant search volume and proven performance.

It’s valuable to instead use search term reports over time to understand the intent of the user as much as possible. Because we no longer have the full data set we used to, here are three things our team is using to supplement what’s left of the search term report.

Other Keyword Sources

If your goal is to shield your campaign from low-intent or irrelevant searches with negative keywords, let’s explore some of the other search term sources our team is turning to:

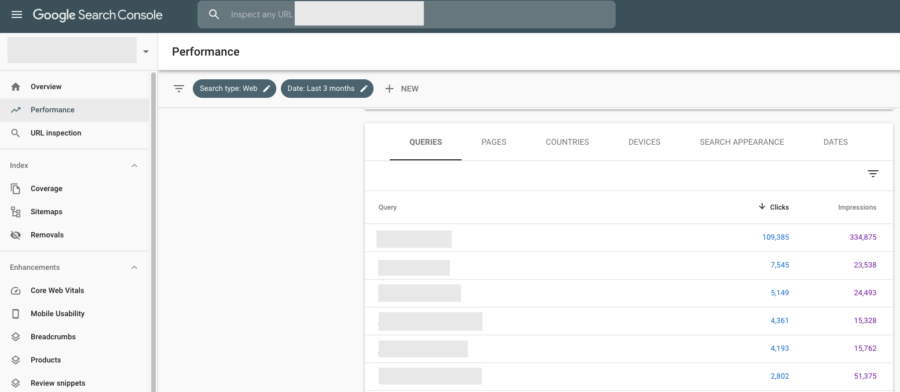

- Google Search Console – Our team loves working with organic search query data in Google Search Console (GSC) for many reasons, and the reduction in Google Ads search term data simply adds one more reason to that list. While organic and paid keyword lists and search query data are often vastly different from one another, there is some useful data to glean from this information. First, GSC search query data may give you a head start on identifying high intent, high click-through rate queries that you’ll want to bid on via exact or phrase match, especially if you’re building a keyword list from the ground up. This eliminates the need to rely on broad match types. On the flip side of this, you may see queries in the GSC report that you immediately know you don’t want to spend ad dollars on. For example, you may see career-related queries or branded queries related to negative press. If your Google Ads strategy is not aimed at either of those objectives, then that research can help round out your negative keyword list.

- Microsoft Ads – This change in search term reporting is (for now) singular to Google. Kirk Williams points out that, while the majority of advertisers apply Google findings to Microsoft Ads, we actually may start gleaning insights from Microsoft Ads, where search term data is still being reported in full, to apply to Google campaigns. While Microsoft Bing does tend to follow Google Ads pretty closely, our team pulls search term data from Microsoft Ads to supplement limited data from Google.

- Historical Google Ads search term data – Because we’re not looking at search terms as a way to actively find negative keywords, there’s a lot to be gained from simply using pre-September 2020 data if it’s available. This is not necessarily a solution that will work for every account or years down the road, but taking an extra deep dive into the historical data could help advertisers form an updated keyword strategy going forward that better accommodates the new search term reporting.

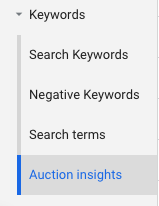

Auction Insights

Although auction insights data is also notoriously incomplete, don’t rule it out. In some cases, you’ll find it can serve as a proxy for search term data. We were recently optimizing a search campaign for a new PPC client and because the search volume is already low for this client’s niche industry, search term data was especially hard to come by. Knowing that a certain keyword had garnered some impressions, but was showing a low click-through rate and no conversions, we looked into the auction insights report for that specific keyword. Auction insights showed only two competing sites, and they were both job board sites – not the search intent we’re going for with our ads.

By seeing the sites that we were coming up against on the SERP for that specific keyword, we got a glimpse into the intent of the searchers that we weren’t able to see from the search terms report and made adjustments to negatives and match types accordingly.

Audience Data

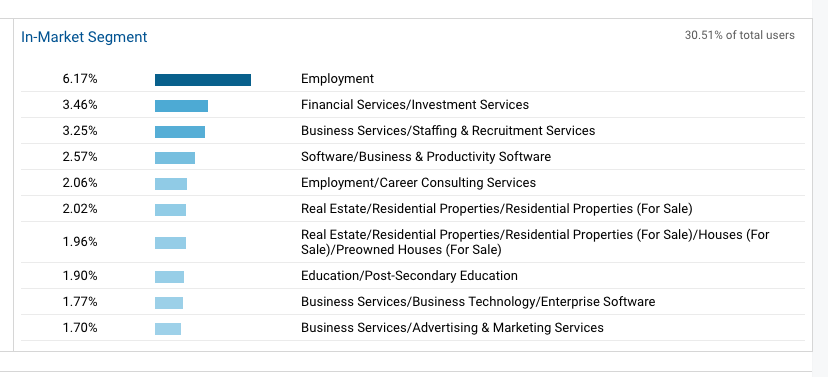

Similar to the above example where auction insights data serves as a proxy for search term data, audience data can serve the same purpose. By looking at traffic quantity and performance data for in-market audiences in both Google Ads and Google Analytics, advertisers may find broad insights into common user intent. If your campaign is lacking a significant amount of search term data and there are indications that intent may be off, in-market audience data may help build a more complete picture.

For example, similar to the auction insights instance above, if you find that a significant portion of traffic coming to your site is categorized as in-market for employment, you may need to tighten up keyword intent or even create a negative bid adjustment for that audience. That way you don’t spend ad dollars on job seekers when finding new clients is your objective.

Another example is one of our clients who has the word “Security” in its name, and while our client is a SaaS company, we often saw searches for a home security company with the same brand name appear in the branded keyword search terms reports. Now that we may not see those search terms as fully, we can use in-market audience data to look for traffic coming to the site whose intent was to find the home security company and optimize accordingly. Of course, this is not a perfect science, and someone looking for a SaaS provider may also be looking for home security, but audience data can help paint a more complete picture of search intent.

Demographic data may also play a similar role in indicating hits and misses in intent. For example, if your target audience is a higher-level decision maker within an organization, many times a younger age bracket may not align with that audience. If your demographic data reveals a high volume of 18-24 age users, that could be an indication that the intent of the search terms you can’t see are possibly more informational than purchase-driven (if you’ve ever seen blatant test question queries in your search term report, you’ll know what I mean).

Conclusion

Loss of access to data for something as important as search terms is undoubtedly a drawback for advertisers on Google. That said, a well-optimized and smartly configured search campaign always draws on insights and learnings beyond just keywords. Successful Google Ads agencies are habitually pulling insights from many sources like the ones above to understand the perspective, motivation, and intent of their target audience.

Search News Straight To Your Inbox

*Required

Join thousands of marketers to get the best search news in under 5 minutes. Get resources, tips and more with The Splash newsletter: